Best Risk Management Methods for Beginners

Every new investor faces the same quiet fear. You've saved money. You're ready to invest. But what if you lose it all? Risk management isn't about avoiding losses completely. It's about knowing which risks are worth taking and which ones will drain your future. Most beginners skip this step and learn the hard way.

Here's what surprises most people: the investors who protect their money best aren't the ones who avoid all risk. They're the ones who use simple methods to control it. Later, you'll discover why the most important risk management tool costs nothing and takes just minutes to set up.

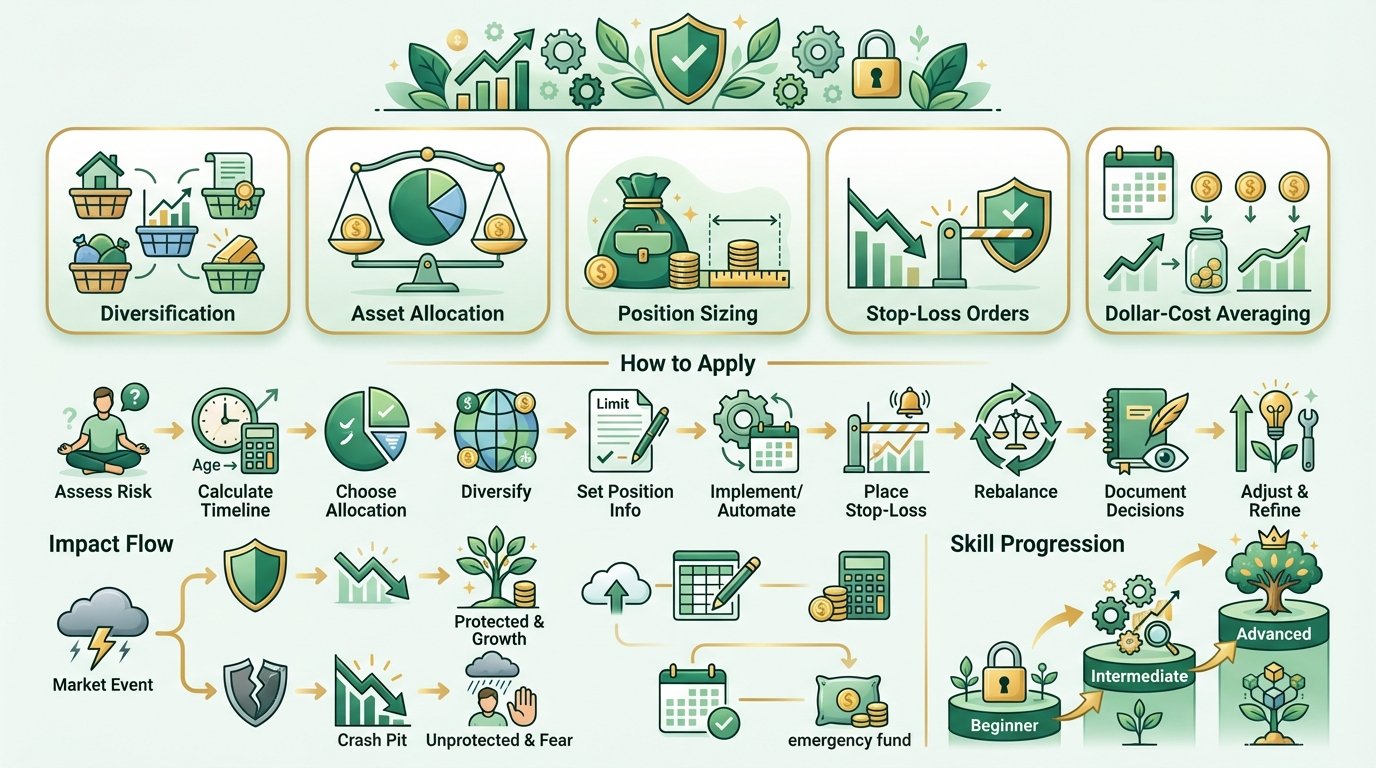

This guide covers the five core methods every beginner needs, from diversification to position sizing. You'll also learn how to build a practice playbook that matches your personal risk tolerance and timeline.

Best Risk Management Methods for Beginners: Foundation and Framework

Risk management is the process of identifying, evaluating, and controlling threats to your investment capital. For beginners, this means protecting your money while still allowing it to grow. The goal isn't zero risk. It's acceptable risk matched to your goals.

Surprising Insight: Surprising Insight: In 2025, portfolio diversification delivered positive results during significant market turmoil, proving that simple strategies still work when complex ones fail. We'll explore exactly how this works in the practice section.

The landscape changed in 2025. Traditional relationships between stocks and bonds shifted due to persistent inflation dynamics and fiscal imbalances. This makes learning proper risk management more important than ever for new investors.

Why Best Risk Management Methods for Beginners Matter in 2025

Without risk management, one bad investment can erase months or years of gains. With it, you sleep better and stay invested during market downturns. The difference compounds over decades.

Risk management serves three purposes. First, it preserves capital so you can invest another day. Second, it reduces emotional decision-making when markets drop. Third, it creates predictable outcomes over time.

Risk Management Impact Flow

How proper risk management transforms investment outcomes over time.

🔍 Click to enlarge

For beginners, risk management isn't optional. It's the foundation that lets you build wealth consistently. Markets will always fluctuate. Your response determines your outcome.

Standards and Context

Not financial advice. These methods represent widely accepted practices from financial institutions, regulatory bodies, and academic research current through 2025.

The SEC and FINRA both recommend asset allocation and diversification as core risk management tools for individual investors. Vanguard and Fidelity provide evidence-based frameworks used by millions of investors.

Risk Tolerance Spectrum

Understanding where you fall on the risk continuum helps select appropriate methods.

🔍 Click to enlarge

Time horizon matters deeply. A 30-year-old saving for retirement has different risk capacity than a 50-year-old. Longer horizons allow more equity allocation and recovery time from market drops.

The Five Core Risk Management Methods

These five methods form the foundation. Master them before adding complexity.

| Method | Purpose | Difficulty | Cost | Time to Implement |

|---|---|---|---|---|

| Diversification | Spread risk across assets | Easy | None | 1 hour |

| Asset Allocation | Balance risk and return | Medium | None | 2 hours |

| Position Sizing | Limit single-trade risk | Easy | None | 10 minutes |

| Stop-Loss Orders | Cap downside losses | Easy | Low | 5 minutes per trade |

| Dollar-Cost Averaging | Reduce timing risk | Easy | None | 15 minutes setup |

1. Diversification: Never Put All Eggs in One Basket

Diversification spreads investments across different asset classes, sectors, and geographies. When one investment falls, others may rise or stay stable. This reduces overall portfolio volatility.

Diversify at two levels. First, between asset categories like stocks, bonds, real estate, and commodities. Second, within each category across different companies, industries, and regions.

2. Asset Allocation: The Strategic Mix

Asset allocation divides your portfolio among major asset classes based on your goals, timeline, and risk tolerance. A common starting point for beginners is the 60/40 portfolio: 60% stocks for growth, 40% bonds for stability.

In 2025, traditional allocations face new challenges. Consider adding small positions in Treasury Inflation-Protected Securities and alternative assets like commodities. Gold rose 30% through mid-2025, showing the value of thoughtful diversification.

3. Position Sizing: The 1% Rule

Position sizing limits how much you invest in any single asset. The 1% rule suggests risking no more than 1-3% of total portfolio value on one trade. This protects against catastrophic single-position losses.

If you have $10,000 to invest, limit any single position to $100-300 at risk. This seems conservative. But it lets you survive multiple losses while learning.

4. Stop-Loss Orders: Automatic Protection

Stop-loss orders automatically sell an investment when it drops to a predetermined price. This limits losses during sharp market downturns and removes emotional decision-making.

Set stop-losses at 5-10% below purchase price for stocks, wider for volatile assets. Adjust as the position gains value to lock in profits.

5. Dollar-Cost Averaging: Consistent Investment

Dollar-cost averaging invests a fixed amount regularly regardless of price. You buy more shares when prices are low, fewer when high. This reduces timing risk and emotional investing.

Invest $500 monthly instead of $6,000 once yearly. You'll average out market volatility and avoid the temptation to time the market.

Required Tools and Resources

You need surprisingly little to implement these methods effectively.

- Brokerage account with low fees (Vanguard, Fidelity, Schwab offer free trading)

- Spreadsheet or portfolio tracking app (Google Sheets works perfectly)

- Risk tolerance questionnaire (most brokerages provide free versions)

- Calendar reminders for regular investing (dollar-cost averaging)

- Basic financial calculator for position sizing (free online tools available)

- Emergency fund covering 3-6 months expenses before investing

- Clear written investment plan documenting your strategy and limits

Total cost: $0 if using free tools. Time investment: 3-5 hours for initial setup, then 1 hour monthly for maintenance.

How to Apply Best Risk Management Methods: Step by Step

Watch this guide to see these methods in action before you begin practicing.

- Step 1: Assess your risk tolerance using a free questionnaire from your brokerage or financial website. Answer honestly about how you'd react to a 20% portfolio drop.

- Step 2: Calculate your investment timeline. Subtract your current age from your target retirement age. Longer timelines allow more stock allocation.

- Step 3: Choose your asset allocation based on results. Conservative: 40% stocks, 60% bonds. Moderate: 60% stocks, 40% bonds. Aggressive: 80% stocks, 20% bonds.

- Step 4: Diversify within each asset class. For stocks, use low-cost index funds covering US, international, and emerging markets. For bonds, include government and corporate bonds.

- Step 5: Set position size limits in your investment plan. Write down your 1-3% rule and commit to following it before each purchase.

- Step 6: Implement dollar-cost averaging by scheduling automatic monthly investments. Most brokerages offer free automatic investment plans.

- Step 7: Place stop-loss orders on individual stock positions at 8-10% below purchase price. Skip this for diversified index funds you plan to hold long-term.

- Step 8: Review and rebalance quarterly. If stocks outperform and grow from 60% to 70% of your portfolio, sell some and buy bonds to restore your target allocation.

- Step 9: Document every decision and outcome in your tracking spreadsheet. This builds pattern recognition for future decisions.

- Step 10: Adjust methods as you learn. After six months, review what worked and what caused stress. Refine your approach based on evidence.

Practice Playbook

Start simple and build skill progressively. Each level prepares you for the next.

Risk Management Skill Progression

Path from beginner safety to advanced optimization.

🔍 Click to enlarge

Beginner: 10 Minutes Daily

Start with a simple three-fund portfolio. Buy a US stock index fund, an international stock index fund, and a bond index fund. Allocate based on your risk tolerance assessment. Set up automatic monthly investments of whatever amount you can sustain. Do nothing else for the first three months except watch and learn.

Daily practice: Spend 10 minutes reading your portfolio value without making changes. Notice your emotional reactions to gains and losses. Write them down. This builds the emotional regulation you'll need later.

Intermediate: Skill Building

After three months of consistent investing, add quarterly rebalancing. When your allocation drifts more than 5% from target, trade to restore it. This forces you to sell high and buy low systematically.

Add individual stock positions cautiously. Limit them to 10-20% of your portfolio maximum. Use the 1% position sizing rule strictly. Place stop-losses on each position. Track results separately from your core portfolio.

Advanced: Professional-Level Nuance

Incorporate tax-loss harvesting. When positions drop 10% or more, sell them to capture losses for tax purposes, then immediately buy a similar but not identical investment to maintain market exposure.

Consider portfolio insurance strategies using options for large positions. This is complex and expensive, so use it only when a single position exceeds 15% of your portfolio and you can't or won't sell it.

Build a personal risk dashboard tracking maximum drawdown, volatility, Sharpe ratio, and time to recovery from losses. Review monthly to understand your true risk exposure beyond simple returns.

Profiles and Personalization

Different life situations require different approaches. Match methods to your reality.

| Profile | Age Range | Primary Method | Allocation | Key Focus |

|---|---|---|---|---|

| Early Career | 25-35 | Dollar-cost averaging | 80/20 stocks/bonds | Build consistent habits |

| Family Builder | 35-45 | Diversification | 70/30 stocks/bonds | Balance growth and stability |

| Peak Earner | 45-55 | Asset allocation | 60/40 stocks/bonds | Protect accumulated wealth |

| Pre-Retirement | 55-65 | Stop-losses + bonds | 40/60 stocks/bonds | Reduce volatility |

| Retirement | 65+ | Income focus | 30/70 stocks/bonds | Preserve capital |

Risk-Averse Beginners

Start with 50/50 stocks and bonds even if young. Use only broad index funds for maximum diversification. Set stop-losses wider at 15% to avoid premature selling during normal volatility. Increase stock allocation by 5% yearly as comfort grows.

Aggressive Young Investors

An 80/20 or 90/10 stock-heavy allocation makes sense with 30+ year timelines. But still diversify widely within stocks. Include international exposure, small-cap funds, and emerging markets. Avoid the temptation to concentrate in individual stocks until you have three years of experience.

Career Changers

During career transitions, increase bond allocation temporarily to reduce portfolio stress while income is uncertain. Build a larger emergency fund before investing new money. Return to normal allocation once income stabilizes.

Learning Styles

Adapt these methods to how you learn best.

Visual learners benefit from portfolio tracking software with charts and graphs. Use tools like Personal Capital or Morningstar to see your asset allocation, risk metrics, and performance visually updated daily.

Analytical learners should build detailed spreadsheets tracking every position, allocation percentage, and risk metric. Calculate position sizes manually before each trade. Review historical data to understand statistical patterns.

Kinesthetic learners learn by doing. Start with small amounts you can afford to lose completely. Make mistakes early with $100 positions rather than later with $10,000 ones. Keep a trading journal documenting what you felt before, during, and after each decision.

Social learners join investment clubs or online communities focused on evidence-based investing. Discuss risk management decisions with others following similar strategies. Avoid groups promoting get-rich-quick schemes or individual stock tips.

Science and Studies (2024-2025)

Recent research validates these methods for real-world investors.

Morningstar's 2025 analysis found that portfolio diversification delivered net positive results during significant market turmoil, even as traditional stock-bond correlations weakened. Diversification still works, but requires broader thinking beyond just stocks and bonds.

iShares research in Fall 2025 documented that investors who added small allocations to TIPS and alternative investments like commodities improved risk-adjusted returns compared to traditional 60/40 portfolios. Gold's 30% gain through mid-2025 illustrated the value of true diversification.

Fidelity's 2025 guidance emphasized that less reliable stock-bond correlations stem from deeper structural forces including persistent inflation dynamics, policy action, and fiscal imbalances. This makes active risk management more important than passive set-and-forget approaches.

Position sizing research consistently shows that limiting single-position risk to 1-3% of portfolio value allows investors to survive the inevitable mistakes all beginners make. This isn't theoretical. It's survival mathematics.

Dollar-cost averaging studies demonstrate that while it may underperform lump-sum investing in consistently rising markets, it significantly improves investor psychology and reduces the regret that causes people to abandon good strategies during downturns.

Spiritual and Meaning Lens

Risk management connects to deeper values beyond money.

Many faith traditions emphasize stewardship over ownership. You're managing resources temporarily, with responsibility to use them wisely. Risk management is stewardship in practice. It respects what you've been given and protects your ability to use it for good.

The Buddhist concept of the middle way applies perfectly to investment risk. Neither reckless gambling nor fearful hoarding leads to peace. Balanced risk management lets you pursue growth without attachment to specific outcomes.

Stoic philosophy teaches us to control what we can and accept what we can't. You can't control market returns. You can control your diversification, position sizes, and emotional responses. Focus your energy there.

For secular humanists, risk management represents rational compassion toward your future self. Present you makes decisions that protect future you from unnecessary suffering. This is practical self-love.

Positive Stories

Real beginners using these methods successfully.

Maria started investing at 28 with $200 monthly. She used a simple three-fund portfolio and dollar-cost averaging. During the 2024 market correction, her portfolio dropped 18%. Because she'd practiced watching her account daily without reacting, she continued her automatic investments. She bought shares at lower prices. Within eight months, her portfolio recovered and exceeded previous highs. Her consistent method meant the correction actually accelerated her wealth building.

James learned position sizing the hard way. He put 30% of his portfolio into a single tech stock based on a friend's tip. The stock dropped 60% in three months. He lost $9,000. After that, he implemented the 1% rule strictly. Over the next two years, he made 40 trades. Twelve lost money. But no single loss exceeded $300. His winners more than covered his losers. He's now up 45% overall and sleeps well.

Sarah and Tom are in their 50s and panicked during previous market crashes. They learned about asset allocation and moved to a 50/50 stock-bond mix matching their risk tolerance. When markets dropped 20% in 2024, their portfolio only fell 10%. More importantly, they didn't panic sell. They rebalanced by buying more stocks at lower prices with their bond allocation. This single decision added an estimated $40,000 to their retirement nest egg.

Microhabit

Check your portfolio allocation once weekly without trading. This builds observation without action. It trains your brain to tolerate volatility. Most beginners either ignore their portfolios completely or check obsessively and overtrade. Weekly observation with no trading for the first 90 days creates healthy detachment.

Set a calendar reminder for Sunday evening. Open your brokerage account. Write down your current allocation percentages. Note how you feel about any changes. Close the app. Do not trade. After 90 days of this practice, you'll have the emotional foundation for active risk management.

Quiz Bridge

Test your understanding before you invest real money.

Next Steps

Start with one method this week. Complete a risk tolerance questionnaire today. Based on your results, choose an appropriate asset allocation. Open a brokerage account if you don't have one already.

Set up automatic monthly investments using dollar-cost averaging. Start with whatever amount you can sustain consistently. Even $50 monthly builds the habit and teaches you the emotional side of investing.

Practice the microhabit of weekly portfolio observation without trading for 90 days. This single practice will build more risk management skill than any book or course.

After three months, add quarterly rebalancing. After six months, consider adding individual positions using strict position sizing if you're interested in active investing. But the simple three-fund portfolio with consistent contributions will outperform most active strategies long-term.

Research Sources

This article is based on peer-reviewed research and authoritative sources. Below are the key references we consulted:

Related Glossary Articles

Frequently Asked Questions

How much money do I need to start using risk management methods?

You can start with any amount. Many brokerages allow fractional share investing, meaning you can diversify with as little as $100. The methods matter more than the starting amount. Someone with $500 using proper risk management will outperform someone with $50,000 who doesn't over time.

Should I use stop-loss orders on index funds?

Generally no. Stop-losses work best for individual stock positions you're actively managing. Index funds held for long-term goals should ride out volatility. Selling during temporary drops locks in losses and misses the recovery. Use asset allocation instead to manage index fund risk.

How often should I rebalance my portfolio?

Quarterly or when allocation drifts more than 5% from target, whichever comes first. More frequent rebalancing creates unnecessary trading costs and taxes. Less frequent rebalancing lets risk drift too far from your comfort zone. Quarterly strikes the right balance for most beginners.

Is diversification still important if I only invest in index funds?

Yes. Diversify across different types of index funds covering US stocks, international stocks, bonds, and potentially real estate or commodities. A single US stock index fund is better than individual stocks, but it's still concentrated in one country and one asset class. True diversification spreads across multiple asset types and geographies.

What if my risk tolerance changes over time?

This is normal and expected. Reassess annually or after major life events like marriage, children, job changes, or inheritance. Adjust your asset allocation to match your current risk tolerance. Shift gradually over 3-6 months rather than making dramatic changes all at once to avoid market timing risk.

Can I use these methods in a retirement account like a 401(k)?

Absolutely. Asset allocation, diversification, and dollar-cost averaging work perfectly in 401(k)s and IRAs. Most retirement accounts offer automatic rebalancing features. The main limitation is you're restricted to the investment options your plan offers, but you can still apply these principles within those constraints.

Take the Next Step

Ready to improve your wellbeing? Take our free assessment to get personalized recommendations based on your unique situation.

- Discover your strengths and gaps

- Get personalized quick wins

- Track your progress over time

- Evidence-based strategies